Every now and again you have one of those moments where you look at something which has been taken for granted as being the norm and question your own sanity when you realise it doesn’t seem to make sense.

Welcome to Right to Buy (RTB). Until quite recently it felt like the Emperor’s New Clothes equivalent in the housing world. Everyone seems to think it is right as everyone else is saying the same. However an increasing number of people are now starting to think what they don’t feel they can say publicly.

RTB isn’t right and we need to start making the case for the policy to be changed or scrapped.

I’m not the first to have said this. David Orr recently published a blog that nailed a number of the key issues.

As in a number of other policy areas, Scotland is way ahead of England on this too. Not only have they signalled their intent to scrap the policy but they are now looking to accelerate this.

So what’s the problem with giving people the opportunity to access a heavily discounted property? Well there are five.

Firstly is the principle of just because we have always done something it must be right. RTB was developed in the early 1980s to enable people to access low cost home ownership. At this time it was a new concept as there were very few other options to enable people to own their own home.

Fast forward 30+ years and we are living in a very different world. There are numerous low cost home ownership alternatives out there, which are designed to work within the wider housing market. In fact it is hard to name all the different schemes that do exist!

The second argument is that RTB leads to mixed communities. It does, but so does the considerable amount of newbuild that housing associations have undertaken in the same period. This is underpinned by in some areas the majority of homes in an area now being owner occupied or privately rented after the original beneficiaries of the RTB discount have moved on.

When I spend time in our neighbourhoods it is all too often the owner occupied properties that are dragging down the standards of the wider neighbourhood. This reflects that in many cases people have pursued the RTB of their home without really thinking through the longer term maintenance obligations or their financial circumstances have changed, which has resulted in them no longer being able to maintain their home to a good standard.

This is further compounded by the level of investment many housing associations have made into their neighbourhoods over the last 10 years, which starkly brings into focus the difference in standards.

Thirdly there is the wholly inaccurate assumption of one for one replacement. This is just completely untrue as a recent analysis by Pete Apps has demonstrated. If these homes were being replaced on a 1:1 basis then there would be less of a problem with RTB. Although it is still right to question the level of discount and extent to which public subsidy is helping a relatively small number of people buy their own homes.

Indeed for organisations like Halton Housing Trust, for every house built we have to sell seven homes under RTB. In the last five years we have lost £2.35 million in RTB discounts on 83 homes. Here are some basic maths to understand the reality:

• £80,000 valuation – 60% discount (£48,000) = £32,000 receipt. Then deduct RTB Sharing Agreement with Council (50%) and this then leaves just £16,000.

• The average build cost (including land purchase etc.) is just short of £100,000, hence why it takes just under seven RTB sales to fund one new home.

• Even if you allow for HCA grant this still reduces the ratio to 5:1.

We have a shortage of affordable housing in this country. Even the range of current measures can’t plug the gap between demand and the right properties in the right place. So why are we compounding the problem with RTB, which merely serves to reduce the number of affordable homes? The Government’s own figures highlight that the number of RTBs have doubled in the last 12 months. This is probably linked to the further discounts applied since 2012.

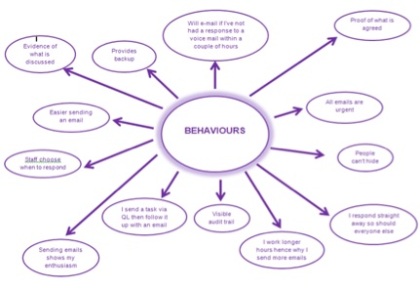

The fourth issue is to look at who is buying homes under RTB. You might reasonably assume that this is the current occupier. Well this is increasingly no longer the case.

Our recent analysis of sales at Halton over the last five years has shown that of 83 homes sold, 18 were made to occupants who were in receipt of Housing Benefit at the time of completion. In other words the property is being purchased by someone else (usually a family member) on their behalf who is then either renting it back to them or have bought as part of an agreement that they will benefit from a future sale when the current occupant moves out for whatever reason.

So the main beneficiary from RTB in 1 in 5 sales isn’t actually the person who is living at the property paying rent. This surely is an abuse of the basis upon which affordable housing has been built using public money in the form of grant to enable the rents to be charged at around 60% of market levels.

Furthermore these homes were built with the purpose and Business Plan financial assumptions of being low cost rented homes and not as a low cost home ownership product. Consequently RTB sales have an adverse impact upon Business Plans and by default our ability to use our assets to build more affordable homes.

It begs the question of who is social housing there for and how is it to be funded to remain ‘affordable’? And how does RTB sit with the wider VFM and ‘sweating assets’ debate?

Then there is the fifth reason. Looking to the future, it is quite feasible that we are sleepwalking into a much bigger problem. Fast forward to 2017 and imagine a world where Universal Credit has now been fully rolled out.

In this post Welfare Reform landscape people will have a ‘guaranteed’ income of between £1,300 and £2,000 (depending upon their household size) every four weeks. For mortgage providers, offering a relatively low mortgage to a household with a guaranteed income from the state borrowed against equity in the home of up to 75% could be very attractive.

Like many others, here at Halton we have also been working with Experian to use our customers rent accounts to increase their credit rating score, but this could also be used to help them secure a mortgage against a heavily discounted home.

For the individual this could also be an attractive alternative to renting and a potential way to reduce their monthly outgoings. This is a real potential ticking time bomb.

So what’s the answer? Well the problem is not so much the RTB Policy itself but the levels of discount being offered. The alternative could be to offer Right to Acquire discounts across all tenures. Or why not widen previous ‘staircasing’ schemes that enable people to buy the home they are living in but for a sensible price, that enables a replacement home to be built in its place.

The impact of RTB needs to be properly examined and debated. The Trust like many others, supports measures that help people into home ownership. But this shouldn’t be done at the expense of housing associations businesses or affordable housing supply. There are better ways of achieving this.

This is not about taking something away. But it is about ensuring we have a supply of affordable, high quality homes for future generations. The time has come for us to be brave and start telling the Emperor to put some clothes back on.